Contents

- Why isn’t my tax calculation enough?

- Key takeaways

- The tax year overview

- Navigating HMRC online to access your tax year overview

- Essential steps to obtain and print your tax year

- Clarifying SA302 tax calculation and its relation to tax year overview

- Tax year overview for different types of income

- Adjustments and corrections in your tax year overview

- Summary

- Frequently asked questions

What is a ‘tax year overview’ and why does it matter?

Self employed people don’t have the luxury of getting a mortgage by providing their payslips. Small business owners don’t have that option either. So they have to work much harder to prove their income and even when they take a salary from their own company, the payslips are ignored because of the “Close Companies” rule.

Since HMRC stopped sending out paper copies of SA302 tax calculations in the post the TYO has become essential for any business owner applying for a mortgage and together with your tax calculation it’s the evidence you need to prove your income.

Remember if you submitted your own self assessment via the Government Gateway then you will still have access to the SA302 online, but if you had your accountant do it or used a third party software then as an alternative you will need to use your tax calculation from the software plus a TYO to validate it.

Before you continue reading…

Our clients enjoy these things as standard:

- Three working hour response time for queries

- Fixed monthly payments and any ad hoc fees pre-agreed

- Full UK based team in the office 9-5 Monday-Friday

- All-inclusive tax planning and software support

- Free representation in the event of an enquiry

Why isn’t my tax calculation enough?

It’s easy to manipulate your tax calculation, perhaps you want to show a higher income than you actually made to get a bigger mortgage.

They could do this by filling in their self assessment and inflating their income or by lying to their accountant, getting them to provide the calculation then adjusting it afterwards once it’s been submitted to the mortgage lender.

A tax year overview with a self assessment calculation will show anyone looking at it that the income numbers were actually filed to HMRC and it’s an official document that complies with the tax laws in the UK.

Key Takeaways

- A Tax Year Overview is generated by HMRC after you submit your self assessment and is proof of income tax liability or refunds for self employed and those applying for a mortgage.

- You can access your Tax Year Overview through the HMRC online portal using your personal or business tax account and the Self Assessment section allows you to view, print and save the tax overview document securely.

- You can adjust or correct your Tax Year Overview within 12 months of the Self Assessment deadline via the HMRC website or phone. This will ensure your financial records are accurate.

The Tax Year Overview

The Tax Year Overview is a document generated by HMRC once you’ve submitted your self assessment tax return. It shows:

- The amount of tax owed or refund due

- Tax payments you’ve made or refunds received

- Interest & penalties on outstanding bills

- Adjustments

- Total current position of everything owed

This is important for self employed as it’s a verification document that validates the tax calculation provided. Before you submit it to a mortgage lender or broker you must check the tax figure on the first line of the TYO matches the calculation you’re providing.

It’s not the most exciting document but I’ll try to be thorough: The tax year overview has a few key purposes:

- To validate your tax calculation was actually filed to HMRC

- To confirm HMRC have received and processed your self assessment tax return

- To confirm HMRC have received your tax payments

It’s a part of your self assessment tax return process to make sure you pay the right amount of tax for the right tax year.

The Role of Tax Year Overviews in Self Assessment

After you’ve submitted your self assessment tax return the Tax Year Overview will show the tax due. This is often used as proof of income when applying for a mortgage. It’s a summary of your self assessment for a specific tax year.

The importance of a Tax Year Overview includes:

- A single view of the total tax liability or refund after you’ve filed your self assessment

- Precision of the amount owed or due to you

- A breakdown of your entire calculation

- Evidence of your income and earnings in the tax year which is vital for tax documentation and validation.

A Closer Look at the Components of Your Tax Year Overview

A Tax Year Overview in the UK brings together information on total income and tax for a specific tax year, the tax bill, tax paid and balance. The income section of your Tax Year Overview shows your individual income, including your Income Tax and National Insurance contributions and how HMRC have allocated these.

Each section of a Tax Year Overview has a purpose. It shows the tax owed or refund due for a specific tax year and a structured summary of total income and tax submissions. The aim is to be transparent and give HMRC and yourself a clear financial picture.

Navigating HMRC Online to Access Your Tax Year Overview

To get to your Tax Year Overview:

- Go to the HMRC online portal.

- Sign in or create a personal or business tax account.

- Select ‘View and manage your Self Assessment tax return’

- Then ‘More Self Assessment details’ and ‘Tax return’

Once you’ve done that you’ll be able to see your Tax Year Overview.

But online portals can be tricky. If you’re having trouble accessing your Self Assessment on HMRC online, such as losing your Government Gateway user ID, service issues or online submission problems don’t worry. You can use online forms, call HMRC or ring the self assessment helpline on 0300 200 3310. You may also need to access another HMRC online document to help.

Sign In and Select Self Assessment

Getting to your self assessment HMRC account is straightforward. Go to the HMRC website and click on ‘Create a Personal Tax Account’. Then register using Government Gateway if you don’t already have an account.

If you’ve forgotten your HMRC online account details you can recover your user ID or password by following the instructions on the HMRC website. Once you’re signed in to your HMRC online account you’ll find self assessment in your personal tax account which is linked to your Self Assessment.

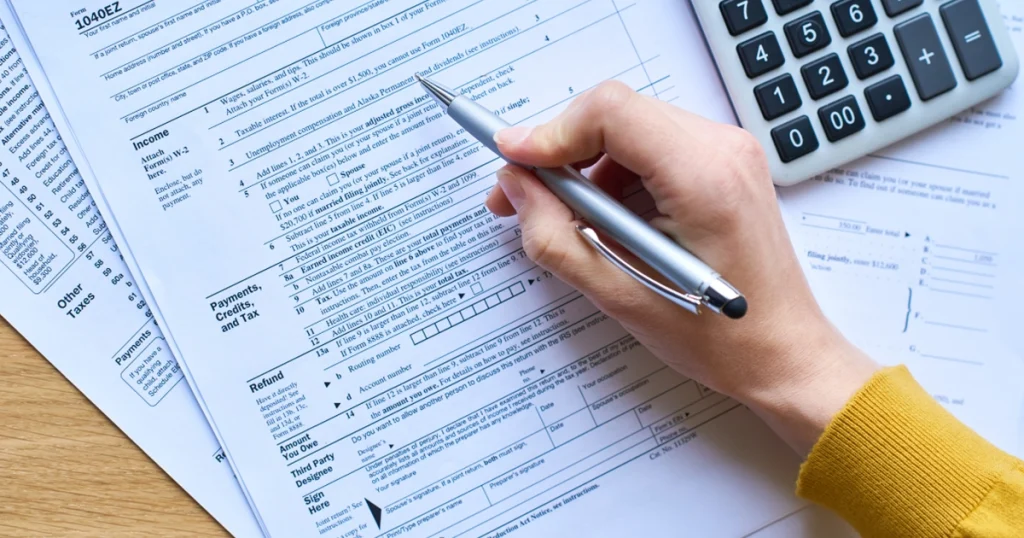

View Self Assessment Return and Tax Overview

Once you’re in and have selected Self Assessment your Self Assessment Return is available on HMRC online using your UTR and National Insurance number. Once in select ‘Self Assessment’ to view or print your tax returns.

Your Self Assessment Return can be downloaded from the ‘Self Assessment’ section of your account. The Tax Year Overview is in the ‘Self Assessment’ section or in the ‘Annual Tax Summary’ section of the HMRC online portal once you’ve completed your tax return.

Essential Steps to Obtain and Print Your Tax Year Overview

Once you have your Tax Year Overview you need to get a copy. To do this:

- Go to your HMRC online account.

- Go to the ‘Self Assessment’ section.

- If you’re only registered for Self Assessment you can print your own tax calculation and tax year overview.

Printing your Tax Year Overview is easy. Here’s how:

- Sign into your HMRC online account.

- Go to the ‘View account’ option on the Self Assessment home page.

- Select ‘Tax years’.

- Choose the year from the dropdown menu.

- Click ‘Go’.

- Then select ‘Print your tax year …’ to print the document.

Securely Saving Your Tax Documents

Saving your Tax Year Overview needs to be done safely. Here’s how:

- Choose the tax year you want to print and click ‘Go’.

- Click ‘Print your tax year overview’.

- Select ‘Save as PDF’.

- Click ‘Save’ to save it on your computer or cloud storage.

Saving as PDF will keep the document intact for future use.

You should save your documents:

- Encrypted flash drives

- Password-protected documents sent via email

- TitanFile

- Long term storage options like personal safes, Google Drive, iCloud, Dropbox with encryption enabled

These will keep your tax documents safe and confidential.

Remember to keep your tax records for at least 22 months after the end of the tax year the return relates to or longer if you’re self employed.

Clarifying SA302 Tax Calculation and Its Relation to Tax Year Overview

An SA302 Tax Calculation is a formal document showing an individual’s income and tax for a tax year. It’s often used as proof of income when applying for a mortgage. The Tax Year Overview is a summary of your tax position for a tax year showing total income and total tax paid. When combined with an SA302 which is the actual tax calculation, they together show the full income and tax submitted to HMRC for that year.

The SA302 has the detailed tax calculations and is a more detailed tax document. The Tax Year Overview is a summary showing only the income for the tax year, personal allowance and the final tax bill for that year.

When Mortgage Lender HMRC Entry Requires Both Documents

To confirm an individual’s income for a tax year, mortgage lenders often ask for the SA302 Tax Calculation. But both the SA302 and the Tax Year Overview are often asked for by mortgage lenders as they are summaries of an individual’s total income and tax submitted to HMRC for a tax year so they can see the full picture of the individual’s financial situation.

The SA302 shows an individual’s income, allowances, taxes and payments, the Tax Year Overview shows the total and payments from the tax return. When combined they show an individual’s income and tax position which is required for income verification when dealing with mortgage lenders.

Tax Year Overview for Different Types of Income

Different types of income including capital gains are taxed at different rates according to the Tax Year Overview. The Tax Year Overview includes self employment income by including it in the SA302 which is a summary of the income reported to HMRC. Rental income from property is also included in your Tax Year Overview. This income is taxed on the net profits of the rental business. Net profits is calculated by subtracting allowable expenses from the rental income.

Including property income in your Tax Year Overview involves:

- Registering for Self Assessment

- Keeping track of landlord tax deadlines

- Gathering all relevant information about rental income

- Calculating allowable expenses

This is required to declare your net profit from property rental.

Incorporating Property Income into Your Tax Year Overview

Including property income in your Tax Year Overview means transferring the property owned by an individual landlord into a Limited Company. Once incorporated the property will be taxed on its rental income and any future earnings.

Jointly owned property for tax purposes is usually split 50/50 unless there’s a reason for an alternative split. For marriage or civil partnership the individual’s share of the rental profits is the percentage of ownership of the property.

Adjustments and Corrections in Your Tax Year Overview

If you find any errors or discrepancies in your Tax Year Overview you must correct them ASAP. You can adjust or correct information in your Tax Year Overview by:

- Go to the HMRC website.

- Select ‘Tax return options’.

- Choose the tax year for the return that needs to be amended

- Open the tax return.

- Make the changes

- Submit the return

Amendments can be made within 12 months of the Self Assessment deadline or the actual filing date of the tax return for that accounting period. Remember accuracy is key to your Tax Year Overview.

Contacting HMRC for Amendments

Changes to your Tax Year Overview can be done by contacting HMRC, managing your online Self Assessment tax return account or asking HMRC for help with Income Tax and Class 4 National Insurance. If online correction is not possible then contact HMRC for further help.

The HMRC helpline can help with queries on amendments to your Tax Year Overview. When contacting HMRC to make changes to your Tax Year Overview remember to provide your personal details such as your name and Unique Taxpayer Reference (UTR) and put ‘amendment’ on every page of the document where you’re making changes.

Summary

In summary, your Tax Year Overview is key to keeping your financial records accurate and making sure you’re paying or receiving the right amount of tax. Whether self employed, a landlord or have multiple income sources, this guide has given you the knowledge to navigate your Tax Year Overview with confidence. If you have any issues or discrepancies HMRC are there to help you.

Frequently Asked Questions

Is a tax year overview the same as SA302?

No, a tax year overview and SA302 are not the same. The SA302 shows more detailed tax calculations and includes all income and tax submitted to HMRC, the tax year overview shows the tax return totals and payments received by HMRC.

How do I get my annual tax summary?

You can get your tax summary online through the Government Gateway. But if you haven’t paid any Income Tax or have outstanding info you won’t be able to access it.

How do I download my tax year overview as PDF?

You can download your tax year overview as PDF by going to the ‘Self Assessment’ tab, selecting the tax year and then ‘Save as PDF’.

What is a tax overview?

A tax overview is a document that confirms your SA302 information is correct and shows the amount of tax due or refund for a particular tax year. It’s produced by HMRC after you’ve submitted your self assessment tax return.

How do I access my Tax Year Overview?

You can find your Tax Year Overview by logging into your HMRC online account and going to the ‘Self Assessment’ tab. If you’re only registered for Self Assessment you can then print your own tax calculation and tax year overview.