Contents

What Drives The Multiple of a Small Business?

How To Fund a Business Purchase

Introduction

The stats around selling a business make for a sobering read, according to expert broker Ian Benson only 20% of business owners will ever try to sell their businesses and only 10% of those will succeed, so the questions I want to answer today is not just how to value a business, but also to be in that 0.2% minority do you have to be lucky? or is there a strategy behind it?

Regardless of if you wish to sell your business or not, I also want to help you understand why most accountants get it wrong by just discussing business turnover or profit, when in reality they should be helping their small business clients focus on the underlying business value and providing management information and planning to manage it.

The irony of building a business people want to buy, is that quite often business owners don’t actually want to sell it, however regardless of your current intentions I’m now going to make the most compelling argument of why you must to focus on your business worth.

Before you continue reading…

Our clients enjoy these things as standard:

- Three working hour response time for queries

- Fixed monthly payments and any ad hoc fees pre-agreed

- Full UK based team in the office 9-5 Monday-Friday

- All-inclusive tax planning and software support

- Free representation in the event of an enquiry

Why you have to have an exit strategy

If you’re a 40 year old reading this article and you don’t have a pension then you should consider this. If you were to start paying £1,500 a month into your pension from today, you would have an annual income of £30k a year by the time you retire at 68 years old, You could add another £10k from your state pension to this figure to get you to £40k and perhaps you will have paid off your mortgage as well and have a lower tax rate and be reasonably comfortable.

While other factors do apply relating to inflation and the growth of your funds and tax free lump sums, but the reality of the situation is that most small business owners don’t have £1,500 a month to spare for their pensions and the only practical solutions for them are to continue working until they drop dead, sell their business and retire off the proceeds or build a business that runs without them.

With the latter two of the three options the focus is the same and increasing the value of your business will achieve either result and give you the flexibility to chose the best exit strategy at a later date.

De-risking

A buyers worst nightmare

Imagine if you paid a million pounds for a company and then it collapsed over night because of something your due diligence process failed to pick up in the valuation figures and business history. Later on in the article I will explain the various factors that contribute to a businesses risk profile, but just from a simplification point of view all you really need to know is that the more established and safe your business is, the higher its business valuation will appear to a prospective buyer.

Protecting your future

As a small business owner, you’ve probably spent the large part of your tenure feeling that the rug was going to be pulled away from under your feet and that is normal because managing financial anxiety for entrepreneurs is part of their job. Ultimately the best way to overcome this anxiety is to build a business that has a very low risk profile because you’ve focused on improving its long term business valuation, rather than short term net profit margins.

The Marketing Behind a Business Valuation

While it’s much easier for a large business or public company to gain an accurate valuation due to it’s market capitalisation and various factors relating to share price, unfortunately there are very few people out there that can accurately determine the value of a business for a private company. While certain surveyors will charge a fortune to produce a valuation report, their business valuation method will only ever be based on industry averages for a similar business and an asset valuation.

The real point I’m making here is that selling a small business is something you’re going to need to become an expert at, with the recognition that business valuations are in fact a marketing activity as much as they are an accounting one and the value you will receive on sale will only ever be based on what you can convince a buyer the business is worth.

Valuation Methods

General Calculation

Sales Value = Goodwill + Net Assets

Net Assets = All Assets (Intellectual property & Tangible Assets) – All Liabilities

Goodwill = (Profit/Revenue/EBITDA) x ???

It always baffles me why businesses focus on Assets minus liabilities when it comes to increasing their value. Ultimately you don’t have a huge level of control over things that are required in the way your own business operates. For example the decision on having a business premises is probably not going to be driven by how it impacts your balance sheet, but more likely on how it will support business operating requirements.

Tangible Assets

The total includes physical assets like equipment and property, also whilst you can’t physically hold your bank account or debts in your hand for the purposes of terminology they also count as tangible assets. Stock if you have been buying it over a period of time can be valued at the weighted average cost and it’s important to make sure its value is completely up to date in the company’s accounts as it is likely to be scrutinised by the buyer.

Equipment and property usually sits on your balance sheet at its net book value, but it’s worth considering that the asset valuation method that most purchasers would rely on would be based on market value so adjustments would need to be made to demonstrate this.

Intangible Assets

Intangible assets are also included in you overall assets calculation and can include copyrights and trademarks, these can be very hard to value due to how unique they are in nature.

It’s clear that the main driver which can be controlled in terms of company valuations is the Goodwill and this is often the largest part of the selling price in a business. Below I’ve outlined four methodologies that can be used:

Times Revenue Method

Often known as the times revenue method, in some industries it is common place to work out the fair price of a business by taking the recurring annual revenue or gross recurring fee and applying a standard multiple to it, to work out the good will.

This is prevalent for accounting firms and I believe the going rate at the moment is around 1 x GRF, however this methodology can be flawed due it not taking into account the very substantial differences in quality and profitability of two businesses in the same industry. At face value studying a similar business may appear to be the obvious guide when it comes to working out how to value a business, but the reality is that if there is a large deal at stake, then a more in depth approach is needed than just looking at comparable companies.

Multiple of EBITDA

Earnings Before Interest Tax Depreciation & Amortisation is a common term which comes up when discussing valuation techniques for larger private companies and also for public companies that have a stock price, market capitalisation value and price to earnings ratio. It’s a fancy way of saying adjusted profit, but is a necessary requirement of many potential investors as it removes the company specific variables in your profit and restates it as a figure that can be easily compared to other organisations that they might also be evaluating for purchase.

The EBITDA is important enough that many organisations ask their accountants to report on it every month in the management accounts and for many established businesses it can be one of their main KPIs to focus on.

Multiple of Adjusted Profit

Their is still a lot of debate on how relevant EBITDA is for small business in terms of business valuation methods, as many owner managed entities don’t actually hold a great deal of physical assets and suffer from depreciation, and often they tend to be funded out of profits with relatively low levels of debt. Working out an adjusted profit figure is far more practical when it comes to determining a small company’s market value, lets look at the formula:

Adjusted Profit = Net Profit + Director’s Costs + Strategic Growth Costs – Cost of Replacing Directors

If someone buys your business then they won’t need to pay you anymore, but they will need to replace you as a director with someone else so factoring in the exchange of management is important for them. It may also be the your Profit & Loss (Income Statement) contains costs relating to future profits or strategic growth and those should be added back to your profit so that you’re not penalised for something the new owners will benefit from.

Discounted Cash Flow Method

The discounted cash flow method creates a company valuation based on the net present value (NPV) of future cash flow. discounted cash flow factors in the time value of money which is kind of a one in the hand is better than two in the bush kind of thing, and totals up the expected future profitability and future cash flows and works out what they are worth if reverse compound interest is applied.

Future Cash Flow

The net present value calculation is similar to a profit and loss but for multiple years, at the bottom it contains a calculation to adjust a profit the might be expected in 5 years time to what it’s value is in todays terms or present value, based on a discount rate that is determined by the purchaser.

The discounted cash flows method can be good for established businesses that are unlikely to be impacted by significant external influences and have predictable cash flows, however there is a lot of subjectivity involved due to the length of the evaluation period or discount rate, for example do you work it out over 10 years or 20 years, what is the infinite residual value? Future growth of the business can also be very hard to predict, even in cases where you have built a very substantial sales & marketing infrastructure.

What Drives the Multiple of a Small Business?

6 Factors

The multiple is the figure you apply to the EBITDA, Adjusted Profit or Revenue to ascertain the market value of your business. As I mentioned earlier a company valuation determines what a potential buyer might pay, but ultimately it is up to you to demonstrate during the valuation process that your business excels at these factors.

Unique Solution

“Me too” style businesses tend not to be worth as much as businesses that have a unique selling point and especially businesses that have protected intellectual property like a patent, copyright, domain or other legal or contractual protection.

Productise to De-commoditise

Ultimately anyone seeking to understand your business valuation will want to understand the level of risk associated with it and unfortunately for many small businesses out there, they can be very vulnerable to their competitors engaging in irresponsible activities like starting a price war or working in a way that will damage the reputation of you industry.

Having a solid USP is the best way to ensure that winning potential customers doesn’t become a race to the bottom when it comes to pricing and margins.

Niching

Businesses that have a broad range of customers really struggle to create a unique solution and to achieve the highest valuation possible it is often important to focus on one type of customer, so you can specialise and become better at delivering a solution to that group of people than anyone else.

Team

While it can be straightforward to hire staff, it certainly isn’t easy to build a high performing team and once you achieve this then potential buyers will give you a much higher business valuation. Of course it does matter who you’re selling it to as they might have their own team and won’t want yours, but realistically this isn’t as much of a factor in the current climate and businesses are eager to collect as many A-players as they can.

Having a great team often has the by-product of allowing you to do an immediate exit from the business after sale, rather than in some scenarios where the seller is expected to stay on as a director for a period of time afterwards.

Management Team

Many business owners seem to be obsessed with the idea of hiring a general manager or director to take over their own responsibilities in the business, but as an accountant advising our clients (of which we have many in the Northampton area and beyond) I do get them to consider the risk this poses on their business valuation. Ultimately relying on one person can leave you in an awful position if they leave and decide to set up on their own and take your customers with them, and while you can have contracts with restrictive covenants in place they are not always practical to enforce, especially if they interfere with someone’s right to work.

The best solution is to develop a management team where you have experts looking after and driving the various functions in your business, that way if you lose one of them it’s not catastrophic as the others can cover for them, but also because no one person understands all of your operations. Having managers specialise in specific areas also enables them to gain a level of expertise that a generalist might not be able to.

Incentivise

Any potential buyer when it comes to determining your business valuation is going to want to understand how stable your team is and the likelihood of them staying on after you have left. They will look at things like how long they have been in the business, their pay structure compared to averages for their profession and also the potential buyer will look at the long term incentives in place, whether that’s through share schemes or bonuses to tie those team members in.

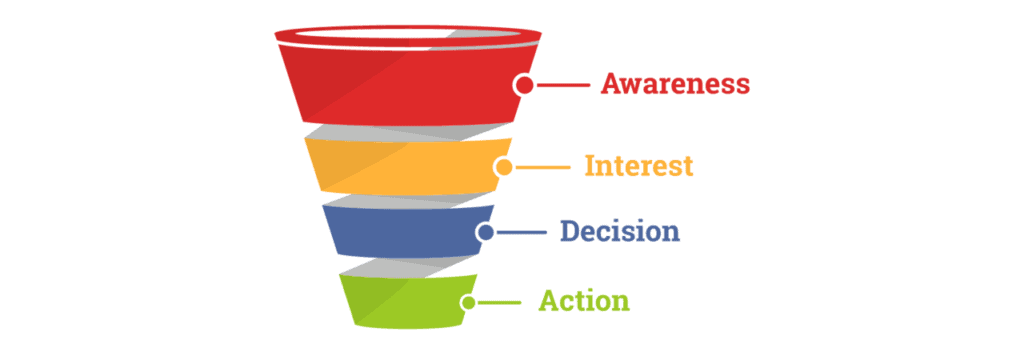

Sales & Marketing Funnel

The sure fire way of achieving a high business valuation is to be able to demonstrate that the future value of the business will increase even without any input from the new owner purely based on the sales and marketing infrastructure you have put in place. This will also do a lot to reassure a buyer that the customer relationships aren’t based on a personal connection with you or a personal brand.

To maximise the value of your business you will need a lead generation strategy in place which is efficient and will provide predictable income. In addition to this you will also want to create a streamlined sales system where you can track leads and have members of your team manage them, the E-myth Revisited talks about the PowerPoint Selling Process which has become the world standard in terms of how to manage a prospect.

Hierarchy of Income

Not all Income is Equal

Quite possibly the biggest factor in how the value of a business is calculated is the way in which it gets paid by its customers, in fact according to business sale expert John Warrilow a £1 of profit generated through subscription based services can be worth 40 x that of a £1 generated in non repeating transactions when it comes to working out the value of your business. Ultimately the value of a business is heavily driven by reducing risk and generating predictable income, so Before I discuss the hierarchy I just need to talk you through some terms:

Transaction = One off exchange of money and services, like when you go to the supermarket

Subscription = A regularly repeating transaction, usually on a monthly basis

Payment Terms = Credit extended to a customer so they pay you after receiving the goods or service

Sunk Cost = Something you have to buy upfront so you can use a product or service, like a razor blade handle.

Tie In = A minimum period of time for which a subscription must be taken out.

The Hierarchy of Income (1 = Best)

Subscription with a sunk cost and tie in

Subscription with a tie in

Subscription with a sunk cost

Transaction with a sunk cost

Transaction with payment on delivery

Transaction with payment terms and a sunk cost

Transaction with payment terms

If you think back to the most successful businesses you’ve seen, you might realise that the way in which they encourage people to buy from them follows a certain trend and they work really hard to get you to trade up into subscriptions even at the cost of immediate profitability, just because they know what it means to their overall business value.

Processes

Process are a huge part in determining the value of a business because they heavily reduce the impact of staff leaving but also improve the the efficiency of operations and reduce costs. McDonalds is internationally renown for for it’s level of standardisation, but what it means to the bottom line is that junior workers at lower rates of pay can produce a burger for a lower cost than another restaurant might be able to. If those staff don’t like their lower pay and leave, then they can be easily replaced because of the excellent process driven training available.

There is also less reputational risk as businesses with good processes and systems tend to have less failures and from a buyers perspective it will reduce the reliance the business has on you as the seller, which means they will pay more and you’ll be able to leave earlier.

Sales Risk

The worst thing that can happen to the buyer of a business is that they pay a large sum of money based on a business valuation and the business then disappears overnight because most of its income came from one or two large customers. If those customers are tied into long terms contracts then that can be reassuring, however the risk still exists and even if they breached their contractual terms it could take years to resolve in which time the business might have folded anyway.

It is incredibly important in maintaining the financial health of a business to ensure that it has multiple customers, while larger ones can sometimes pay more there can often be other strings attached which create additional risk or add complexity to your operations that may be undesirable for a potential buyer.

What is a Buyer Looking For?

Contracts – Typically anyone you speak to who has sold a business in the past will tell you the importance of having solid contracts in place, whether they relate to customers, suppliers or even your team. There is nothing less exciting than holding up a business sale because you have to track people down and get them to retrospectively sign an agreement.

Financial Records – Potential purchasers will already be sceptical about your profitability claims and will sometimes have a team that will go through your businesses financial health with a fine tooth comb. Despite recommendations “from the man down the pub” it is absolutely essential that you don’t take any artificial steps to make your profit look healthier than it is, because a credible buyer will be able to see past this and it will damage your trust.

It is also really important to be transparent with any asset valuation method you have used as well as the valuation method for any stock and other equipment being held, sometimes the value on your balance sheet isn’t good enough and you will need to bring surveyors or other experts in to work it out and sign it off.

Complexity – Explaining to a potential buyer how smart you are, will not do you any favours when it comes to securing a lucrative valuation. Humility will go a long way here, the buyer needs to understand that your average person could run the business, as that might be all they have available. Simplicity in your operations reduces risk, which increases sale price.

Solid Business Plan – For the healthiest valuation a potential buyer will want to understand that their is already a plan in place to scale the business and grow future value. Distressed sales based on the business owners being burnt out do not tend to fetch a high value, so it’s imperative for your business valuation that you show that the business will excel without you and that you’re leaving for other reasons.

Financial Health – Overall having healthy cash flow and profitability makes a huge difference to the enterprise value, while exceptional items on your P&L or balance sheet can sometimes be explained, overall it is difficult to fool someone about the financial health of a business and if you are being irresponsible with your finances and expenditure then a buyer could potentially look at it as unfixable.

For example if your team are used to luxury team meeting and parties, how easy would it be to take that away from them?

ROI – From a buyers perspective return on investment is often a key consideration as investors will have many different opportunities to utilise their funds and get a return on them. From a return on investment perspective, buyers aren’t just evaluating your business vs other businesses, they may also have property development opportunities or the ability to buy shares in a public company that’s listed on the FTSE stock exchange.

For a private company it can sometimes be harder to demonstrate the ROI as there is less external analysis of your performance, where as for public companies there are many external agencies working out stock price and publishing various ratios and formulas to work out the business value.

Who Buys a Business?

Private Equity – Private equity organisation often buy businesses, although it tends not to be a full purchase and the original owner ends up still being a minority shareholder. Sometimes the deal comes with conditions that the purchaser needs to be paid back by a certain time and this can force a business into liquidation in extreme scenarios.

Sellers to need to consider how comfortable they are being a minority shareholder in their own business or if not a minority at least having other stakeholders that they need to answer to and run decisions by.

Business Owners – Sometimes other businesses will want to acquire your business, perhaps because they want access to your customer base so they can sell them a complementary product, or perhaps because they want your team to help them get access to the market segment you currently occupy.

Competitors – You may have several competitors that might want to grow their own businesses, acquire your team or maybe even get you out of their way. They can often be a good buyer as they understand the potential in your industry, but you have to be really careful about disclosing your inner most secrets and workings. Confidentiality and Non-disclosure agreements are a must and need to be in place before any discussions begin.

Potential Business Owners – It can be a bit more challenging to sell to someone who has never bought one before, mainly due to a lack of understanding about the value of a private company. The starting point will be to identify their level of business based knowledge regarding a valuation method as you will want to rule them in or out quickly so they don’t waste your time.

Selling your private company isn’t always about cash and you will also need to spend time evaluating any potential buyer to see what their intentions and qualifications are. Ultimately your team can sometimes also become your family so you will need to put steps in place to ensure that they are looked after and your legacy is protected.

Multiple Averages

You might be reading this and thinking that I still haven’t discussed a ball park figure in terms of what you can expect to sell a business for. I’ve got some rough idea’s for very average businesses listed below, but it’s worth considering that these are for a business based in the UK and don’t necessarily mean that a concerted effort has been made to maximise the value of the business.

Owner Managed – 3 to 4 times profit

Manager in Place – 6 to 8 times profit

Asset Sale vs. Share Sale

Tax on a Business Sale

Share Sale

From a tax perspective to get the best deal it is often necessary to sell the whole company in what is known as a share sale. The benefit of this is that the sale proceeds go straight to you and you can then apply the entrepreneurs relief rate of 10% tax to the amount if it’s less than a £1 Million, or 20% on any proceeds over that. Entrepreneurs Relief is also know as Business Asset Disposal Relief and has been the subject of many tax hikes of the last few years, but it is still very valuable to anyone selling their business.

Asset Sale

The alternative is what we call an asset sale and it involves selling the brand and assets of the business from your limited company and into someone else’s. The challenge with the asset sale is that technically your limited company has been paid for the business and not yourself as an individual. You are then left with the challenge of paying corporation tax on the money you made on the sale and then further dividend or capital gains taxes when you extract the money from the company.

The conflict between buyer and seller

Based on the tax scenario I’ve outlined it is clear that a seller wouldn’t want to go down the route of an asset sale, however from a buyers perspective that would be the preferred option as it means that they are reducing the risk of any previous issues in your business becoming their problem. This could be issues relating to taxes, employees or other legal commitments.

Usually for a buyer to agree to a share purchase they would need certain guarantees and indemnities from the seller and sometimes even a discount to sweeten the deal. It’s worth also considering that sometimes even where there is an asset purchase, there can be personal elements relating to it for example in situations where you own the business premises or perhaps intangible assets like domains, which means that you can apply the entrepreneurs relief rates to the proceeds.

How to fund a Business Purchase

Loans – It is possible to obtain a bank loan in order to fund the purchase of a business and as with most asset related loans the lender will expect you to provide some form of deposit and in certain cases even personally guarantee it as well. Loans tend to be easier to access for businesses in industries that are regulated and have some form of protection and barrier to entry, as well as to purchasers who can demonstrate that they have solid background in the industry.

Seller Funded – It can sometimes be possible to buy a business by using the seller to fund the purchase, in reality that would work by the buyer putting down a smaller deposit and then agreeing with the seller to pay them back out of profits over the coming years. There is a significant risk for the seller in this type of arrangement, so demonstrating your credibility as a purchaser is paramount in securing this type of deal.

Buying a Business for Free – If you’ve ever heard of people talking about how they bought a business for a £1 or were paid to take over a business, then it might almost seem too good to be true which is why I want to explain how it works. Sometimes the owner will really want to sell shares in their business because they need to get out, but they might have a business no one wants to pay for.

It may also be the case that they can’t just close it down because it might have a significant amount of debt that has been personally guaranteed by the owner. In this instance they might be quite happy to give away the business assets or even pay to have them taken away, as long as the buyer also takes the debts and allows the seller to leave.

Business Brokers

I wanted to finish this article with a word of warning about business brokers. While there are many honest professionals out there, the industry is also not regulated which means it’s also rife with cowboys preying on the hopes and dreams of people looking for a business exit.

Don’t

Sign up to long term contracts

Use brokers that won’t list their prices on their website

Assume you have to use a broker

Use commission only brokers

Pay high upfront fees

Automatically go with the one that gives you the highest valuation

Summary

So why am I writing this article as an accountant? It’s because I’ve spent my career frustrated about the focus that small business owners and other accountants place on turnover and profitability. I really want to convey the importance for anyone involved in business, of focusing on the business valuation, by getting it right you will automatically build a healthy, profitable business that you enjoy running.

If your current accountant doesn’t know how to manage and increase the value of your business, then it’s definitely time to reach out to me.